1

Dr. Kevin Bracker, Dr. Fang Lin and Jennifer Pursley

Chapter Learning Objectives

After completing this chapter, students should be able to

- Define what is meant by finance and describe some of its primary areas

- Define and compare/contrast sole proprietorships, partnerships, and corporations

- Identify key advantages/disadvantages of the corporate form of ownership

- Define and identify key characteristics of stocks and bonds

- Define the primary goal of financial management and identify the three elements that impact achieving that goal

- Explain and apply the concept of risk aversion

- Explain how social responsibility and ethical behavior is consistent with maximizing shareholder wealth

- Define the concept of agency relationships and explain how they influence the goal of maximizing shareholder wealth

What is Finance?

There are many different definitions of finance, but for the purposes of this course, we are going to define it as follows:

Finance refers to the process of allocating capital in order to optimize the risk-adjusted expected return on that capital.

This can apply to corporate finance where firms are allocating capital across various operations within the firm, making decisions which long-term projects they should undertake, developing dividend policy, planning how to raise funding, etc. It can also apply to banking where financial institutions evaluate who to lend money to and how much to charge in interest rates. It can apply to personal finance where individuals develop budgets to manage their spending and make investments to meet future goals, such as retirement.

There are several primary areas of finance. These include:

Commercial Banking/Financial Institutions

- Commercial banks, credit unions, insurance companies and countless other financial institutions are an important part of the financial landscape. These institutions deal with financial concerns such as risk management, time value of money, financial intermediation, providing short-term and long-term financing to individuals and businesses, payment processing, and many other activities critical to the financial environment.

- Banks and other similar financial institutions are among the primary employers in the field of finance.

- While we will deal with some issues that are of concern to these financial institutions (time value of money, risk/return analysis, types of financial instruments, etc.), this class will not be primarily focused on banking-related issues.

Investments

- One of the common images associated with finance is the stock market. The field of investments deals with stocks, bonds, options, mutual funds, futures, and many other financial instruments.

- Some of the key considerations in the field of investments include valuation analysis, risk/return analysis, diversification, and fit (by fit we mean that what may be a good investment for one individual may be a poor investment for someone else due to each person’s unique set of investment objectives.)

- There are many career paths related to investments including stock analyst, fixed-income analyst, portfolio manager, trader, etc. These careers tend to be very competitive, demanding, and offer the potential for high income.

Personal Finance

- Personal finance deals with a variety of financial decisions made on the personal level. This includes areas such as retirement planning, insurance, personal budgeting (e.g. can I afford a new house or new car?), and any other financial decision that a person makes.

- While personal finance is not the primary topic of this course, it is an important issue for everyone AND overlaps with many of the main themes (time value of money, diversification, valuation analysis, etc.) that we will talk about in this class. Due to its importance and overlap with our primary focus, we will spend a fair amount of time this semester discussing personal finance issues.

- The most common career path associated with personal finance is the financial advisor/planner. A financial advisor works with individuals to help them achieve their personal financial goals. Financial planning is an expanding field and is consistently rated very high in job ranking evaluations due to its combination of potential income and job satisfaction.

Corporate Finance

- The terms Corporate Finance, Business Finance, and Managerial Finance are often used interchangeably and refer to the field of finance dealing with financial decision making from a business perspective.

- Primary topics for corporate finance deal with raising capital (issuing stocks, bonds, or other forms of financing), paying dividends, maximizing value for shareholders, evaluating potential long-term investments that the firm will undertake (e.g. building a new warehouse), and managing the firm’s cash flows.

- Students with a strong background in accounting are often among the top candidates for jobs in the field of corporate finance.

This textbook will touch on several of these topics (interested students may find more information about potential finance-related careers at the Careers-in-Finance site), but our primary focus is going to be on Corporate Finance. In order to do this, we must start by defining the concept of the corporation (firm).

Forms of Business Organization

There are three basic forms of business organizations – sole proprietorships, partnerships, and corporations. Our focus this semester will be on the corporation, but at this point we should introduce all three forms (in a simplified manner) to give the basic framework of each.

There are three basic forms of business organizations – sole proprietorships, partnerships, and corporations. Our focus this semester will be on the corporation, but at this point we should introduce all three forms (in a simplified manner) to give the basic framework of each.

Sole Proprietorship

A sole proprietorship is a business organization where the owner is a single person and is solely responsible for control of the business. While the owner can hire employees (and managers), it is ultimately the owner that is in charge. One important characteristic of a sole proprietorship is that, from a legal and tax perspective, there is no real distinction between the owner and the business. The owner is liable (legally and financially) for the actions and liabilities of the business. Also, the income is only taxed once (as opposed to being taxed at both the business and personal level).

Partnership

A partnership is structured much like a sole proprietorship except that now there are multiple owners. Again, there is no distinction between the owners and the business as they are all liable (legally and financially) for the actions and liabilities of the business. Also, like in a sole proprietorship, the income is only taxed once. In practice, there are different types of partnerships (general vs. limited vs. limited liability). The general partnership is what is described above. A limited partnership involves at least one general partner to manage the company and take on the risk. The limited partners are passive investors. Finally, a limited liability partnership allows partners to limit their legal (limited to each partner’s behavior) and financial liability (limited to the assets of the business) while still maintaining the tax structure of a general partnership. Note that specifics of partnership law vary by country and by state.

Corporation

A corporation is a firm owned by many individuals (stockholders) who in most cases have little input in operating the firm. A fundamental component of the corporate form of ownership is the separation of ownership from the process of managing the firm. The owners (stockholders) elect a board of directors who are responsible for hiring management and overseeing the direction of the firm’s operations. Corporations account for the bulk of business activity in the US because most large firms are organized as corporations. Specifically, while approximately 17% of business tax returns were filed by corporations, they accounted for about 82% of total revenues by businesses and 62% of taxable income according to IRS SOI Tax Stats in 2015. Because most large firms are organized as corporations, accounting for the bulk of business activity, and corporations are more complex, we will focus on the corporation in our coverage of finance this semester.

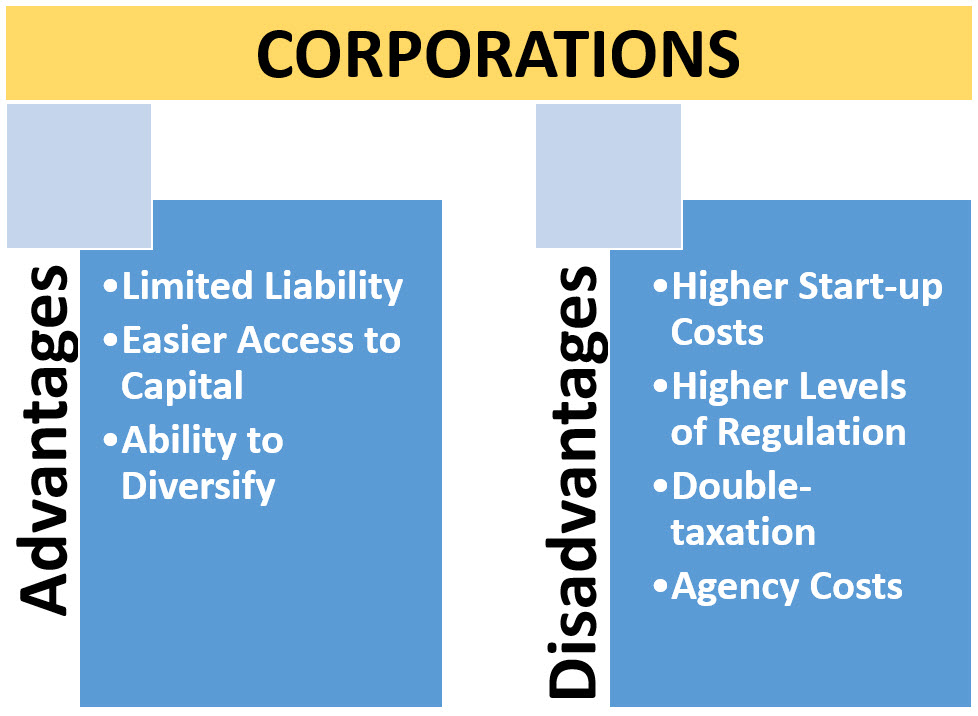

Advantages of Corporations

Limited Liability

Due to the separation between business and the owners, stockholders are typically not liable for anything beyond their initial investment. When buying a share of stock and becoming an owner in a corporation, an individual can lose his entire initial investment if the company goes bankrupt, but nothing beyond that. Remember that this is not the case for sole proprietorships or general partnerships.

Easier access to capital

Corporations have access to the capital markets by issuing shares of stock or issuing bonds. This makes it easier to raise large sums of money for expansion or a multi-year, profitless startup that is anticipated to generate significant profits after the startup stage. Sole proprietorships and partnerships find it much more difficult to raise significant amounts of capital. Snap, Inc. (Snapchat) is an example of a limited liability corporation that recently became a publicly traded corporation via an Initial Public Offering, IPO. The Snap IPO was offered March of 2017 with an original price of $17 per share. Upon opening, demand for the popular IPO pushed the price to $24 per share (a 44% increase) giving the company a $32 billion dollar valuation. Despite several red flags investors continued to purchase Snap stock. The company had yet to see an operating profit, losing $500 million in 2016 and $372 million in 2015, and its net worth for 2016 was a mere $1.5 billion. Over the following few months the stock price gradually fell, trading significantly below its original offering price of $17 per share (all the way down to about $5 per share in Dec. 2018). As of January 2021, Snap is trading for around $50 per share, lost just over $1 billion in 2019 and is worth over $70 billion. See the current price of Snap.

Ability to Diversify Ownership

Corporations allow individuals to own multiple businesses without having expertise in all (or even any) of these businesses. This allows an investor (owner) to reduce her risk and take advantage of opportunities that would not be accessible without corporations. The chance of an investor owning multiple businesses in different industries as a sole proprietorship is minut (due to time, capital and expertise issues). Alternatively, it is easy for an individual to invest $5000 into a mutual fund and become a part owner of hundreds or thousands of different businesses.

Disadvantages of Corporations

Higher start-up costs and higher levels of regulation

Because there is a separation between the owners and the business, there are higher regulatory costs associated with keeping owners informed about business operations. Publicly traded corporations must follow SEC guidelines pertaining to registration and reporting (such as audited annual and quarterly reports) that are costly. According to a report by Protiviti in 2016, the average firm spent between $1,113,000 and $1,442,000 in internal compliance costs to comply with Sarbanes-Oxley regulations. This is just one of the regulatory costs associated with being a corporation. These expenses lower the profitability of the company, but may be necessary to protect shareholders.

Double-taxation

Because the owners and the business are treated as two separate entities under the corporate form of ownership, both are taxed. The business must pay corporate income taxes on any income it makes. When investors make money through dividends (a distribution of corporate profits to owners) or through capital gains (an increase in the value of a share of stock) these are taxable. The current tax code taxes dividend income and long-term capital gains at a lower rate than ordinary income which substantially reduces (but does not eliminate) the impact of double-taxation. Given the volatile nature of tax codes, the impact of double-taxation is likely to fluctuate over time.

Agency Costs

This topic will be discussed in more detail later, but essentially, it is the idea that the owners of the company are not handling the decision-making. Therefore, there is the potential for the decision-makers to run the firm more in their own self-interest rather than in the best interest of the owners (shareholders).

While our focus will be on the corporation, many of the same ideas apply to other types of business organizations (such as sole proprietorships, partnerships – limited or general, S corporations and limited liability companies) as well as personal financial decisions.

Stocks vs. Bonds

The two primary sources of financing for corporations are stocks (equity) and bonds (debt). These are essential financial instruments that we will discuss in depth throughout the semester. Let us introduce the basic characteristics of these securities (a “security” is just a generic name for a financial instrument) now.

Stocks

Stocks are a form of ownership (equity) in a corporation. When you own a share of stock, you are actually a part-owner of the corporation. Large corporations have several million (or in some cases billion) shares outstanding, so when an individual owns 100 shares they own a very small fraction of the firm. For example, Exxon Mobil had 4.23 billion shares outstanding in January 2021, while Amazon had 501 million and Winnebago had 33.6 million at that time. As an owner, you are entitled to a piece of the company’s profits (on a pro-rated basis equivalent to the percentage of ownership). The firm can choose to distribute those profits back to shareholders in the form of dividends or reinvest them back into the company. Sometimes firms will engage in buying back shares of their own stock as a substitute (or in addition to) dividends as a way to return profits to shareholders. We need to be careful because there are other reasons why firms may engage in buybacks, but while the COVID pandemic of 2020 saw companies cut dividends and buybacks, they were still quite strong. When firms reinvest the profits back into the company instead of paying them out as dividends, the value of the firm should increase (assuming the profits are reinvested wisely) which will result in capital gains. Thus, your return from owning stock can come from two sources — dividends and/or capital gains. Because the dividends and capital gains essentially represent your portion of the company’s profit, they can fluctuate dramatically over time. Dividends represent the portion of the profit that is CURRENTLY being paid out while capital gains are dependent on investors’ expectations of FUTURE profits.

Some companies expand rapidly and are extremely successful leading to high returns. Others struggle (or even go bankrupt) and lead to negative returns. As such, the returns associated with stock ownership are highly volatile and risky. Because investors are risk-averse (a concept we will introduce shortly), stocks must generate higher expected returns than safer investments (like bonds) in order to attract investor interest. Note that this does not mean that any individual stock (or stocks in general) WILL generate a higher return, only that its EXPECTED return will be higher.

A final issue associated with stocks is that there is no maturity date to stock ownership. When you buy a stock, you own it until you decide to sell or the company goes bankrupt. Theoretically, the timeline for this type of security is potentially infinite. However, in practice, we find that publicly traded companies have a much more finite lifespan of approximately 15 years. In the article, Where Do Firms Go When They Die the author discusses this relatively short lifespan. Note that this refers to the stock itself, not the investor’s holding period which may be as short as a few seconds or as long as several decades.

Stock Summary

- Ownership (equity)

- Variable cash flow (return) stream — dividends and capital gains

- Higher risk and (on average) higher returns

- Potentially infinite time horizon

Bonds

Bonds are a form of debt. When you buy a bond, you are lending the issuer money (in addition to corporations, governments – federal, state local and international – also are large issuers of bonds). The loan is structured so that the bondholder (typically) receives a fixed interest payment (referred to as a coupon payment) every six-months until the bond matures. At maturity, the bondholder receives the last coupon payment and the par (or maturity) value. Unlike dividends (which firms can increase, decrease, or discontinue at their discretion), promised coupon payments on bonds must be made to bondholders on time or the company can be forced into bankruptcy. Bondholders are first in the priority of payments and must receive their promised payments before the stockholders get anything. Due to this priority of claims, the fixed cash flow stream (coupon payments and maturity payment), and the fixed time horizon, bonds are considered lower risk than stocks. Given this lower risk, bonds will typically have lower expected returns (note – there can be exceptions where the bond of a firm that is exhibiting financial stress may be riskier and have a higher expected return than the stock of a large, stable company). Again, a lower EXPECTED return does not mean a lower return for any particular bond or for bonds in general in a particular year. In any given year, bonds can earn higher returns than stocks, but typically, over longer periods of times, stocks usually earn higher returns than bonds.

Interested students can compare historical returns for the S&P 500, 3-month Treasury bills and 10-year Treasury bonds on a data page by Aswath Damodaran. Since 1928, stocks (as measured by the S&P 500) have had annual returns that are about double that of 10-year Treasury bond (bonds issued by the US Federal Government). Alternatively, the volatility of annual returns over this same time-period has been almost three times as high for the S&P 500. Note that the higher return of stocks, significantly understates the benefit over this time period if one is not aware of the power of compounding. Specifically, $100 invested in stocks at the start of 1928 grew to $502,417 by the end of 2019. The same $100 invested in 10-year Treasury bonds over the same time grew to $8,013. In other words, while the average return was about twice as high for stocks (9.71% vs. 4.88%), the total wealth accumulation was over 62 times as high during this time frame.

Bond Summary

- Debt (loan)

- Fixed cash flow stream — coupon and maturity payments

- Lower risk and (on average) lower returns

- Fixed time horizon

Goal of the Financial Manager

The goal of the Financial Manager is to Maximize the Shareholder Wealth (side note — sometimes this is referred to as Maximizing Firm Value since increasing the value of the firm increases shareholder wealth.)

- The Magnitude of Expected Cash Flows

- The Timeliness of Expected Cash Flows

- The Riskiness of Expected Cash Flows

The above idea is a central theme that will underlie everything we do this semester!

Key Points regarding the Primary Goal of the Financial Manager

Note that in the 3 factors impacting firm value listed above we use cash flows NOT earnings (net income). While there are many similarities between earnings and cash flows, they are not the same. We should always focus our attention on cash flows instead of earnings. Cash flows are considered more important than earnings for three basic reasons:

- The accrual-based approach of net income accounting can distort the timing of when cash is received or spent. Time value of money recognizes that money spent today is more costly than the same money spread out over years. Therefore, something like depreciation may understate the financial cost of owning assets.

- Generally Accepted Accounting Principles (GAAP) or International Accounting Standards (IAS) allow corporations some flexibility in how they account for revenues and expenses. Firms that choose to aggressively apply GAAP/IAS may mislead shareholders by reporting artificially high earnings. Cash flows are harder to manipulate than net income (earnings).

- Cash is the life-blood of a business. Ultimately, it doesn’t matter if the firm is profitable on an EARNINGS basis if it isn’t generating enough cash to pay its employees, suppliers, creditors, etc. The firm needs to generate positive cash flows in order to maintain its operations.

The word Expected is a critical component of the three factors. While what has happened in the past is not irrelevant, the relevance is based on how it might impact future cash flows. Investors base their valuation decisions on the future of the firm. When analyzing stock price changes to information, it is always essential to consider what the new information is RELATIVE TO what expectations were. An analogy would be to compare two students in junior high. The first student normally gets As in her classes while the second student normally gets Cs. Both come home with several Bs on their report card. While both received the same grades, one will likely result in disappointment while the other will likely be celebrated. The difference is not the performance, but the performance relative to expectations. With stocks, new information causes investors to revise their expectations for future cash flows to the firm. If the new information is better than previously expected, investors revise cash flow forecasts upward (and the stock price goes up). If the new information is worse than previously expected, investors revise cash flow forecasts downward (and the stock price goes down).

The three key elements (magnitude, timeliness, and riskiness) are not individual goals. Everything else being equal, higher cash flows are preferred to lower cash flows, less risk is preferred to more risk, and earlier receipt (later payment) of cash flows is preferred to later receipt (earlier payment). However, things are rarely equal. Increasing the magnitude of cash flows usually means taking on higher risks. Less risk usually means lower expected cash flows. Thus, we need to keep the primary goal (maximize firm value) in mind and realize that the interaction of risk, magnitude, and timeliness are more important than any one separately.

The concept of maximizing firm value is not specific to finance. The purpose of marketing, internal accounting, personnel decisions, production, etc. is to maximize firm value. When an individual is hired in any field, the rationale for that decision is that the company plans for that person to directly or indirectly increase its value. If you are an employee of a corporation and are not adding value, what reason do the shareholders have to pay your salary?

Risk Aversion

While the concept of risk aversion has been addressed briefly in the previous discussion of stocks and bonds, this is a topic worth exploring in more detail as it is a critical assumption underlying the analysis that will be covered as the semester unfolds.  Risk aversion refers to the idea that investors don’t like risk. All else equal, if two investments have the same expected return investors will choose the one with the least risk. However, risk aversion does not mean investors avoid risk at all costs…only that they need to be paid to take on extra risk. If investors were risk minimizers instead of merely risk averse, the stock market would not exist as investors would not take the risk associated with investing in stocks, regardless of the higher expected return. Investors will take on extra risk, assuming they receive ADEQUATE compensation for doing so.

Risk aversion refers to the idea that investors don’t like risk. All else equal, if two investments have the same expected return investors will choose the one with the least risk. However, risk aversion does not mean investors avoid risk at all costs…only that they need to be paid to take on extra risk. If investors were risk minimizers instead of merely risk averse, the stock market would not exist as investors would not take the risk associated with investing in stocks, regardless of the higher expected return. Investors will take on extra risk, assuming they receive ADEQUATE compensation for doing so.

Does adequate seem like a vague word? It should, because it is intentionally vague. The reason for this is because people have different levels of risk aversion depending on their personality, their age, their income, and several other factors. Some people are highly risk averse (needing significantly higher expected return to take on a little more risk) while others are only mildly risk averse (needing only slightly higher expected return to take on significantly more risk). To summarize:

- We will assume all investors are risk averse

- Risk aversion implies investors do not like risk

- If two investments have the same expected return, investors will choose the one with the least risk

- Risk aversion is NOT risk minimization, investors will take on more risk if they are adequately compensated for that risk

- The level of risk aversion varies from individual to individual

Social Responsibility and Ethics

Social Responsibility

Social Responsibility refers to the concept that businesses should be actively concerned with the welfare of society. Examples may include establishing scholarship funds, contributing to the arts, or “matching” employee’s contributions to charities.

Ethics

Ethics refers to standards of conduct or moral behavior. Examples may include exceeding minimum safety requirements for employees, abiding by (or exceeding) regulations regarding environmental issues, honoring not just the letter, but the spirit of contracts or verbal agreements with customers and suppliers.

Social Responsibility and Ethics are NOT inconsistent with the maximization of firm value. While there is a cost to engaging in ethical and socially responsible behavior, there are often benefits in goodwill and public relations that may more than offset those costs. There is substantial evidence that engaging in Social Responsibility and Ethics is highly consistent with maximizing shareholder wealth. A study by Margolis, et al (2009), reviewed 251 other studies examining social responsibility and firm performance. They find a consistent pattern that social responsibility is correlated with firm performance. Specifically, the overall mean correlation is 0.13 (indicating a small, positive relationship). In addition, 28% of the studies reveal a statistically significant, positive relationship, 59% reveal no relationship, and only 2% suggest a statistically, negative relationship (with about 10% not reporting a sample size to make statistical significance impossible to measure). This implies that the overwhelming evidence suggests that corporations behaving in a manner consistent with social responsibility and ethical behavior are likely to either benefit financially or not experience any noticeable financial downside to doing so. In other words, companies that do the right thing will either generate additional financial rewards to shareholders or, at the worst, not cost their shareholders.

However, we must remember that while social responsibility is consistent with our primary goal (maximizing shareholder wealth) it is not the primary goal in and of itself. While it seems wrong to say that a corporation can spend too much money on trying to improve the welfare of society, keep in mind that the owners of the corporation are the stockholders. When a corporation writes a large check to a charitable organization, essentially the managers of the corporation are deciding where and how to spend the stockholders’ money. It would be fairer to let those stockholders decide how to allocate their money.

For an example of some firms that rate high in social responsibility and ethics, take a look at Business Ethics List of 100 Best Corporate Citizens.

International Issues

One critical aspect to maximizing firm value is recognizing that business is global not national. Census for January 2021 shows there were 330 million people in the US and 7.7 billion people on the planet. Marketing solely to the US excludes over 95% of potential customers. While not every customer has equal purchasing power, it makes no sense to exclude 95% of your potential customers. From an economic standpoint, the majority of economic activity is also outside the US. According to Worldbank GDP Ranking, in 2019 the US had GDP of $21.4 trillion while global GDP was $87.8 trillion. This means that 76% of economic activity occurs outside the US (up from 70% in 2005). In addition to our customers, many of our competitors and/or suppliers may be based internationally. Therefore, if we ignore the global aspects of business, we are not maximizing firm value.

If we think of international business from the three aspects of maximizing shareholder wealth (magnitude, timeliness, and riskiness of expected cash flows), we can see that international business is likely to have a significant, positive impact on the magnitude of expected cash flows. The timeliness is likely to be slightly slower, but not nearly as significant. The riskiness can go either way. On one hand, international operations introduce new risk factors (political, cultural, exchange rate, etc.). On the other hand, sometimes international operations can help diversify away (a topic for a later chapter) some of our risk. How do we know that international business is an essential element to maximizing shareholder wealth? S&P Indices report, In most years the S&P 500 firms that report a breakdown of foreign revenues report between 40-50% of their revenues from foreign countries. Since these are among the largest firms in terms of market values, clearly foreign revenues are a key component of maximizing firm value.

Agency Relationships

An Agency Relationship exists any time one or more people (the principals) hire another person (the agent) to perform a service and then delegates decision-making authority to that person. The central issue with agency relationships is potential conflict of interest between the principal and the agent or between two or more groups of principals.

Agency problems can cause difficulties in maximizing firm value. The major agency conflict we will focus on is between managers and stockholders (owners). Stockholders hire managers under the goal of maximizing firm value as doing so will maximize the wealth of shareholders. However, the manager may operate under the goal of maximizing his happiness instead of firm value. This may take the shape of overspending on perks (office decorations, company jets, etc.) or on limiting risk in order to protect job security, even at the expense of favorable risk-adjusted return opportunities. There are many ways to try to control for agency costs, including:

The Threat of Firing

While most people understand the threat of being fired, this is not an overwhelming threat to most top managers (although it is more credible for other employees of the firm). Many Chief Executive Officers (CEOs) get rich compensation packages (Golden Parachutes) even if they are forced out of their position. Also, there are some instances where the Board of Directors (the people responsible for hiring and paying the CEO) may be “friendly” to the CEO. In many cases, the CEO is also the Chairperson of the Board of Directors.

The article, The Top 20 CEOs With Even Bigger Golden Parachutes than Marissa Mayer’s, list the CEOs who hold the largest Golden Parachutes in the S&P 500.

The Threat of Takeover

If a firm is purchased by another firm, the acquiring firm may replace upper management. One reason for a takeover is that the management team is not maximizing firm value. If others feel that they could run the firm in such a way as to make it more valuable, they may buy the firm with the intention of bringing out this additional value. However, takeovers are not cheap. Most acquiring firms pay premiums of 20% to 50% to complete a takeover. For example, if the stock price before the takeover is $50, the takeover offer may be $70 per share. This leaves a lot of room for mismanagement. If a firm’s assets are worth $60 per share under optimal conditions, but under current management are only valued at $50, management is not maximizing firm value.  However, it may not be bad enough to justify a takeover. Also, many firms use defenses (Poison Pills) that make takeovers harder to execute. For example, there may be a clause in the debt agreements that all debt becomes due in the event of a takeover.

However, it may not be bad enough to justify a takeover. Also, many firms use defenses (Poison Pills) that make takeovers harder to execute. For example, there may be a clause in the debt agreements that all debt becomes due in the event of a takeover.

Influence of Large Shareholders

This is a relatively new form of Corporate Governance that is gaining prominence. Activist investors may pressure management to run a more efficient operation. If a shareholder with a large stake in the firm creates enough pressure on management and the board of directors, changes to the firm’s strategies and/or operations may occur.

Compensation Packages

The best way to make managers interested in maximizing value is to pay them based on their stock performance. This is often accomplished through payment with stock options (the right to purchase shares at a fixed price even if the stock goes higher). Also, many CEOs own significant amounts of stock in the company they work for. Caution must be exercised that compensation is based on maximizing value and not other factors. For example, compensation based on the size of the company’s assets may create incentives to make investments that increase assets without adding value. Also, compensation based on meeting sales targets may get met by selling items for a loss (which reduces firm value). Finally, stock options may be the most popular way of trying to align the interests of shareholders and managers but they also have some serious flaws. Specifically, the way many options packages are granted they reward short-term fluctuation in the price of the stock more than long-term value creation. There have also been issues related to the timing of option compensation that has acted more as a wealth transfer to executives rather than an incentive. Compensation packages must be carefully designed to align the interest of management with the objective of creating shareholder wealth in order to minimize agency conflicts.

Another agency conflict arises between the two principals, the stockholders and bondholders. Because of the difference in the way stockholders and bondholders are compensated, their attitudes towards a “worthwhile” investment may be different. This can lead to conflicts between which projects to undertake. Generally, bondholders prefer low-risk investments (as their potential return is limited) and stockholder prefer higher risk investments (assuming the higher risk is compensated by higher return).

The better we can control these agency problems, the better our chances of maximizing firm value. The term corporate governance is used to describe the policies that firms have in place to better align agency issues. Two studies that address this are Gompers, et al, 2003 and Cuñat, et al, 2010). These studies provide evidence that improving corporate governance results in higher shareholder wealth.

Key Takeaways

Finance deals with the allocation of capital in order to optimize the risk-adjusted return earned on that capital. While the concept applies to both personal and business oriented decisions, the focus of this course will be first on corporations and secondarily on personal issues. The corporation is a form of business organization that separates out management from ownership and accounts for the bulk of business activity within the U.S. The primary objective of financial management within the corporation is to maximize shareholder wealth. This is accomplished by focusing on the magnitude, riskiness and timeliness of expected cash flows. Three larger issues that influence this goal are social responsibility and ethics, international business operations, and agency relationships.

Exercises

Question 1

Define a corporation.

Question 2

Explain the concepts of limited liability and double-taxation and how they relate to the corporate form of ownership.

Question 3

One of the “disadvantages” of the corporate form of ownership is the higher regulatory cost. One of the large costs facing corporations is the cost of preparing and verifying financial statements. Who ultimately pays for this and does it benefit shareholders? Discuss.

Question 4

What are the two primary instruments corporations issue to raise money? Explain the primary characteristics of each.

Question 5

What is the goal of financial management? What 3 elements are essential to meeting this goal?

Question 6

Why should we concentrate on Cash Flows instead of Earnings Per Share?

Question 7

One of the key assumptions in finance is that people are risk averse. What do we mean by risk aversion? Does this seem to be a valid assumption? Explain.

Question 8

Assume that for $1 you could buy a coin flip that would pay you $2 for heads and nothing for tails. If you are risk averse, should you take the coin flip? What if the coin flip cost you $0.90 instead of $1? What is the lowest price that YOU would take to accept the coin flip and why might this be different for others?

Question 9

How does globalization relate to the concept of maximizing firm value?

Question 10

Explain what is meant by social responsibility and ethics? Discuss how these issues relate to the primary goal of the firm?

Question 11

Define an agency relationship. What major agency problem do corporations encounter? What can be done to help minimize this problem?

Question 12

One of the more controversial issues facing corporations today is the issue of executive compensation. Make an argument for the current state of executive compensation being okay and an argument in favor of regulation to reduce executive compensation. Base your arguments on the concept of shareholders and wealth maximization. After considering this would you be in favor of regulations?

SOLUTIONS to CH 1 Exercises

References

Cuñat, Vicente, Gine, Mireia and Guadalupe, Maria, The Vote is Cast: The Effect of Corporate Governance on Shareholder Value (February 17, 2010). Available at SSRN: http://ssrn.com/abstract=1555961 or http://dx.doi.org/10.2139/ssrn.1555961

Gompers, Paul A., Ishii, Joy L. and Metrick, Andrew, Corporate Governance and Equity Prices. Quarterly Journal of Economics, Vol. 118, No. 1, pp. 107-155, February 2003. Available at SSRN: http://ssrn.com/abstract=278920

Margolis, Joshua D. and Elfenbein, Hillary Anger and Walsh, James P., Does it Pay to Be Good…And Does it Matter? A Meta-Analysis of the Relationship between Corporate Social and Financial Performance (March 1, 2009). Available at SSRN: https://ssrn.com/abstract=1866371 or http://dx.doi.org/10.2139/ssrn.1866371

Attributions

Revised Image: Close-up of Hand Holding Pencil over White Background by Lum3n.com licensed under CC0

Image: Stock Exchange World Economy Bull by Geralt licensed under CC0

Image: Dice over Newspaper Profit by FreeGraphicToday licensed under CC0

Revised Image: Pills Medicine capsule Health by OpenClipart-Vectors licensed under CC0